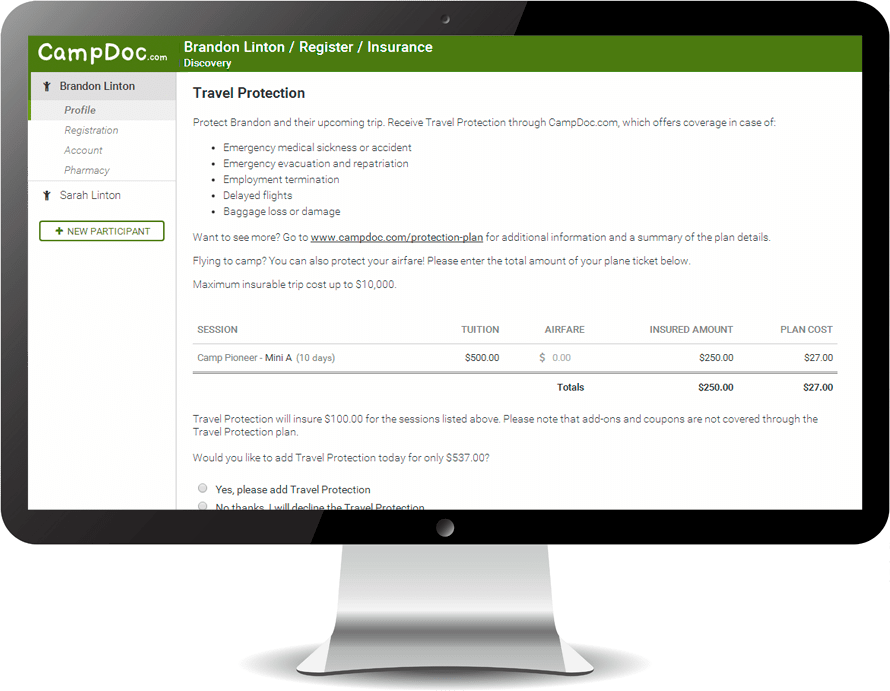

CampDoc offers travel and emergency medical protection, helping camp owners and directors to have comfort knowing campers and their families are protected!

Before your parents wave goodbye to their campers as they head off to summer camp, help make sure they are protected. There is a lot of risk out there, and it pays to help protect campers from the unexpected.

What happens to pre‐paid deposits or non‐refundable travel arrangements if a camper needs to cancel? What if a camper breaks an arm in the wilderness and needs a helicopter evacuation? Who pays for the airfare home when a trip gets cut short?

Help safeguard against unknown risks at the time families begin investing in their child’s summer experience with travel protection from Travel Insured International. For those camps already using the CampDoc electronic health record and online registration system, everything will integrate directly into CampDoc, and there will be no additional cost to the camp if they would like to offer this benefit to their families.

Cancellation and Interruption

Reimburses program costs in case of a participant’s cancellation or interruption due to a covered event. Covered events include sickness or injury, or a parent losing their job.

Emergency Medical Expenses

Provides participants with coverage for emergency medical expenses in case of sickness or accidents during their program.

Coverage and Services

Help protect your camper and your upcoming program. Each benefit and its maximum benefit amount is listed below:

BASIC PLAN

- Trip Cancellation** 100% of non-refundable insured Trip Cost*

- Trip Interruption*** 150% of non-refundable insured Trip Cost*

- Trip Delay Up to a maximum of $750

- Baggage & Personal Effects $1,500

- Baggage Delay $250

- Emergency Medical Expense $25,000

- Emergency Evacuation & Repatriation $250,000

- Accidental Death & Dismemberment $25,000

- Travel Assistance Services Included

DELUXE PLAN

For added protection, consider our Deluxe Plan. This includes all the coverage and services of our Basic Plan with the addition of Cancel for Any Reason coverage.

Cancel for Any Reason will reimburse up to 75% of the insured program cost when you cancel for any reason not otherwise covered by this plan. Coverage must be purchased at or before final trip payment. Cancellation must be at least 48 hours or more before the scheduled departure date. However, this benefit does not cover cancellation due to the failure of your camp to provide the bargained-for Travel Arrangements due to cessation of operations for any reason. Please review the plan description for full terms and conditions.

* Up to the lesser of the Trip Cost paid or the limit of coverage on Your confirmation of coverage

** Trip Cancellation is not applicable when $0 Trip Cost displayed on Your confirmation of coverage

*** $500 Return air ticket cost only if $0 Trip Cost displayed for Trip Cancellation on Your confirmation of coverage

The above was created by and represents the opinions of Travel Insured International. This page contains highlights of the plans, which include travel insurance coverages underwritten by United States Fire Insurance Company under form series T7000 et. al., T210 et. al. and TP-401 et. al. The Crum & Forster group of companies is rated A (Excellent) by AM Best 2021. C&F and Crum & Forster are registered trademarks of United States Fire Insurance Company. The plans also contain non insurance Travel Assistance Services provided by C&F Services through Active Claims Management (2018) Inc., operating as “Active Care Management”, “ACM”, “Global Excel Management”, and/or “Global Excel”. Coverages may vary and not all coverage is available in all jurisdictions. Insurance coverages are subject to the terms, limitations and exclusions in the plan, including an exclusion for pre-existing conditions. In most states, your travel retailer is not a licensed insurance producer/agent, and is not qualified or authorized to answer technical questions about the terms, benefits, exclusions, and conditions of the insurance offered or to evaluate the adequacy of your existing insurance coverage. Your travel retailer may provide general information about the plans offered, including a description of the coverage and price. The purchase of travel insurance is not required in order to purchase any other product or service from your travel retailer. Your travel retailer maybe compensated for the purchase of a plan. CA DOI toll free number: 800-927-4357. MD Insurance Administration: 800-492-6116 or 410-468-2340. The cost of your plan is for the entire plan, which consists of both insurance and non-insurance components. Individuals looking to obtain additional information regarding the features and pricing of each travel plan component, please contact Travel Insured: P.O. Box 6503, Glastonbury, CT 06033; 855-752-8303; customercare@travelinsured.com; California license #0I13223.